World's First

AI-Led, Low-Code, Audit-Ready Technology Compliance Platform

Transform third-party risk management into your strategic competitive advantage. RegAhead PartnerHub revolutionizes how Banking, Financial Services, and Insurance organizations manage IT outsourcing compliance, converting regulatory headwinds into strategic growth opportunities.

Platform Value Proposition

Proactive Risk Mitigation

Identify and address risks before they impact operations with AI-driven predictive intelligence

Enhanced Trust Posture

Build stakeholder confidence with always-on compliance monitoring and instant proof of compliance

Operational Excellence

Save hundreds of hours annually through intelligent automation and streamlined workflows

Regulatory Mastery

Stay ahead of evolving RBI, EBA, GDPR, and international outsourcing regulations

Audit Readiness

Generate regulator-ready reports and documentation instantly with comprehensive audit trails

Cost Optimization

Reduce compliance operational costs by up to 70% through intelligent automation

Scalable Architecture

Enterprise-grade platform that grows with your digital transformation journey

Seamless Integration

Deep connections with existing GRC, ERP, and security systems for unified visibility

Future-Proof Technology

AI-first platform designed for emerging technologies and regulatory frameworks

Key Platform Statistics

75%

Reduction in compliance operational costs

80%

Accelerate audit cycles for quicker completion

99.9%

Platform uptime with enterprise-grade security

50+

Regulatory frameworks and standards supported globally

Why RegAhead

Compliance isn’t a checklist - It’s your competitive edge!

Forget the rigid platforms and one-size-fits-all checklists. RegAhead is low-code, purpose-built for modern compliance leaders who need real adaptability, real control, and real results.

Proactive Risk Mitigation

Identify and address risks in real-time – not just during audits. With always-on controls monitoring.

Enhanced Trust

Build trust faster with a dynamic Trust Center and instant proof of compliance for prospects and partners.

Improved Efficiency

Automate 90% of compliance, risk, and vendor review tasks, saving hundreds of hours every year.

Introducing RegAhead

IT Outsourcing Compliance Platform

A comprehensive Third-Party Risk Management (TPRM) platform designed specifically for BFSI organizations to manage, monitor, and mitigate risks associated with their third-party relationships, including vendors, suppliers, partners, and contractors.

for

Client

Client Portal

The organization that outsources its IT services. It entrusts the management and execution of certain IT functions to the service provider to support its users’ needs and streamline operations.

for

Partner

Partner Portal

The third-party company contracted to deliver IT services on behalf of the client. It assumes responsibility for specific tasks ensuring that end-users receive the expected level of service.

for

Auditor

They independently evaluate and verify TPRM program effectiveness, ensuring compliance with risk management policies, regulatory standards, and contractual obligations for all third-party relationships.

Our Solutions

Accelerate your business goals with us

For

Banking & Financial Services

Ensures financial institutions maintain regulatory compliance and mitigate vendor-driven operational and cyber risks

Compliance Toolkit

Tailored to your needs.

Our platform delivers a comprehensive suite of features designed to streamline your third-party risk management and compliance processes. From automated onboarding to real-time risk monitoring, we empower your organization to make informed decisions, enhance operational efficiency, and ensure regulatory readiness.

Outsourcing Opportunity

Lifecycle

Track and manage outsourcing decisions with structured workflows that embed risk considerations from inception through closure.

Partner Onboarding

Lifecycle

Fast-track third-party approvals with automated onboarding journeys that ensure comprehensive risk assessment without operational delays.

Materiality Assessment & Partner Tiering

Segment partners by risk impact using intelligent tiering tools that align with regulatory materiality thresholds and business criticality.

Audit Management

& Reporting

Ensure audit readiness with real-time dashboards and on-demand reports that satisfy regulatory examination requirements.

Risk Monitoring &

Remediation

Detect, assess, and remediate risks proactively with automated triggers and AI-powered early warning systems.

Initial & Periodic Risk

Assessment

Standardize reviews with periodic evaluations aligned to evolving threats and regulatory expectations, ensuring continuous compliance.

How This Solutions

Works for you.

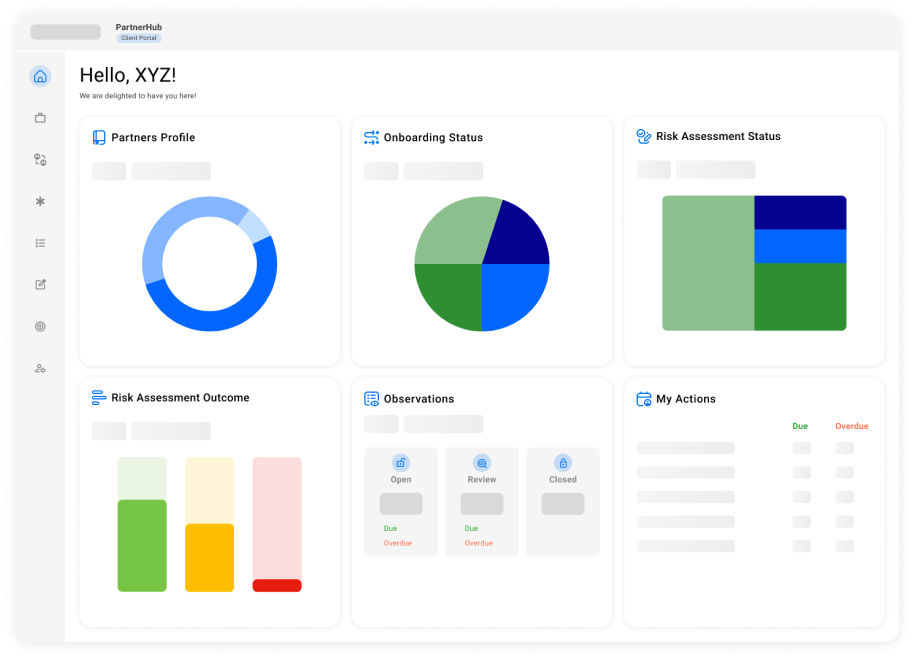

Unified Compliance Governance Views

Providing a centralized platform for monitoring, managing, and reporting compliance across multiple frameworks, enhancing transparency and control for organizations.

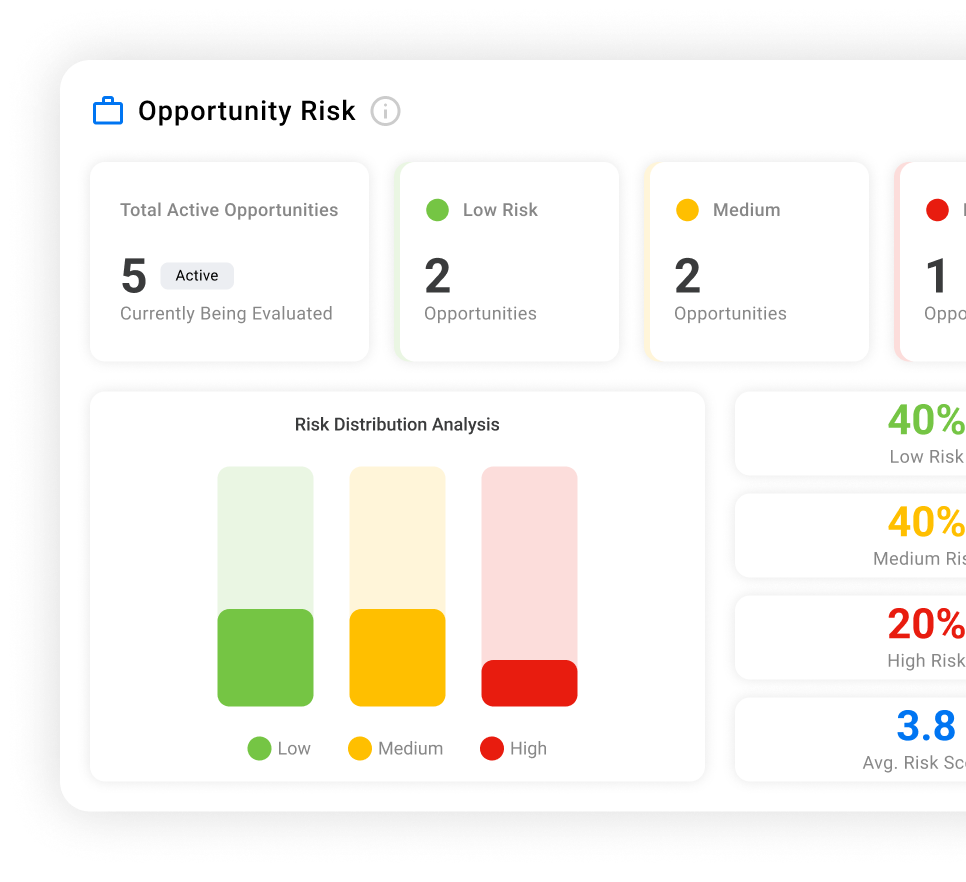

Opportunity Risk Evaluation

Identify and evaluate potential risks tied to business opportunities with data-driven insights. Make informed decisions while balancing innovation and compliance requirements.

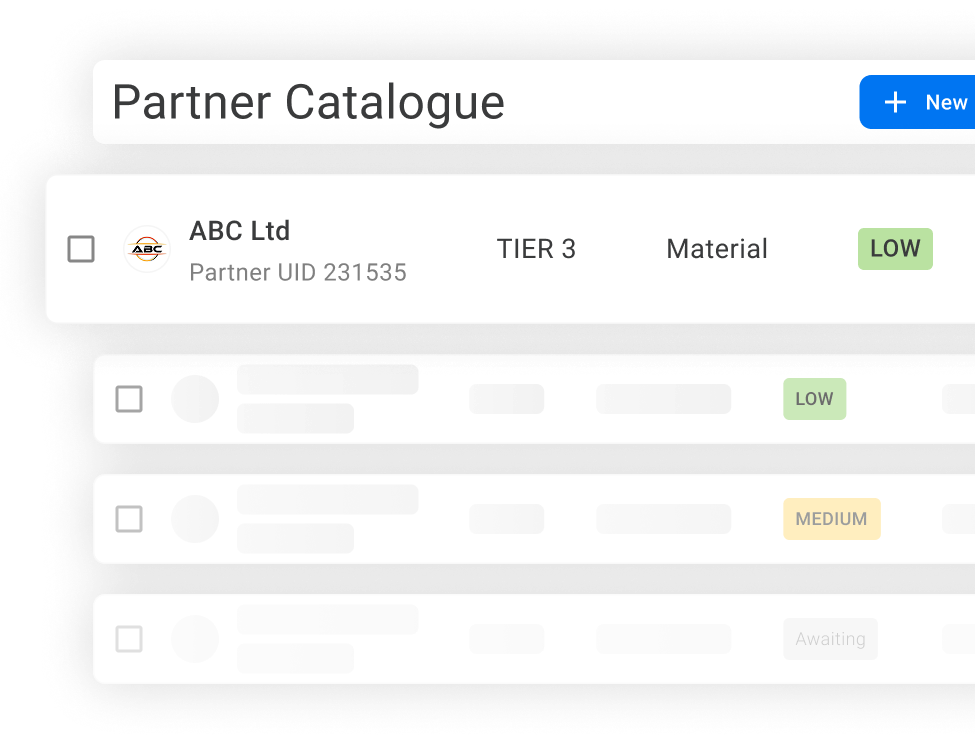

Centralized Partner Inventory

Maintain a unified, searchable inventory of all partners. Gain complete visibility into partner compliance status, risk posture, and due diligence documentation.

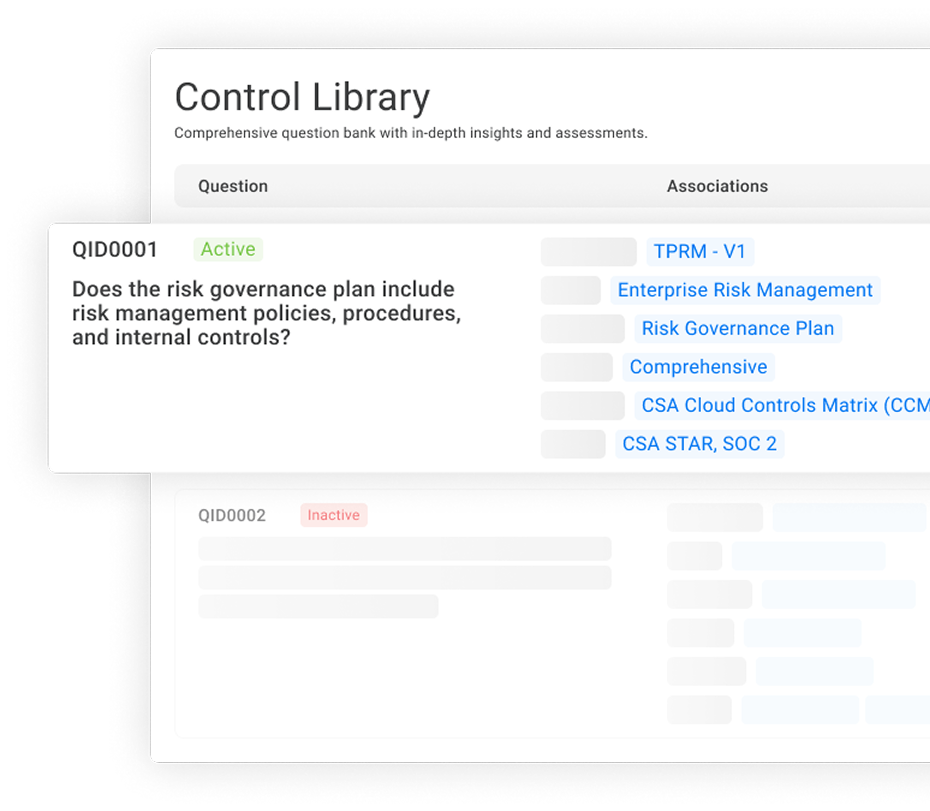

Global Compliance Control Library

A centralized repository of standardized compliance questionnaires used during partner onboarding. Enables consistent due diligence across jurisdictions by aligning partner assessments with regulatory and internal control

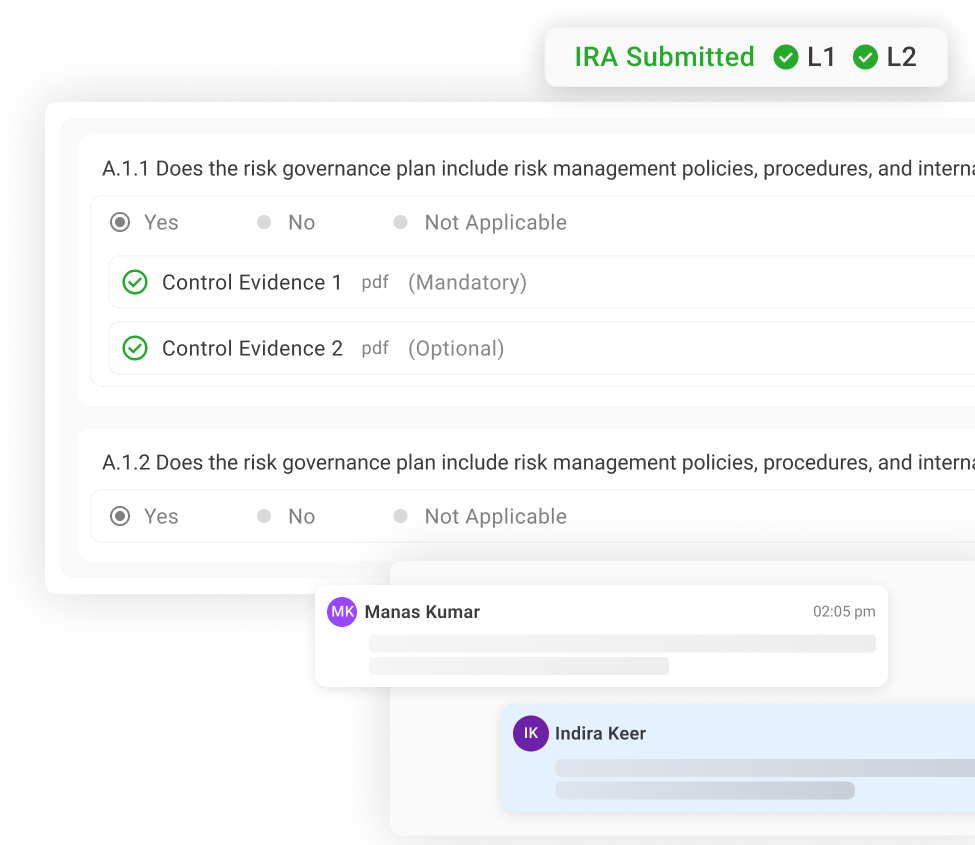

Simplified Assessment Submissions

Automate and streamline compliance self-assessments with dynamic, role-based workflows. Reduces manual errors and ensures alignment with internal control frameworks and regulatory reporting requirements.

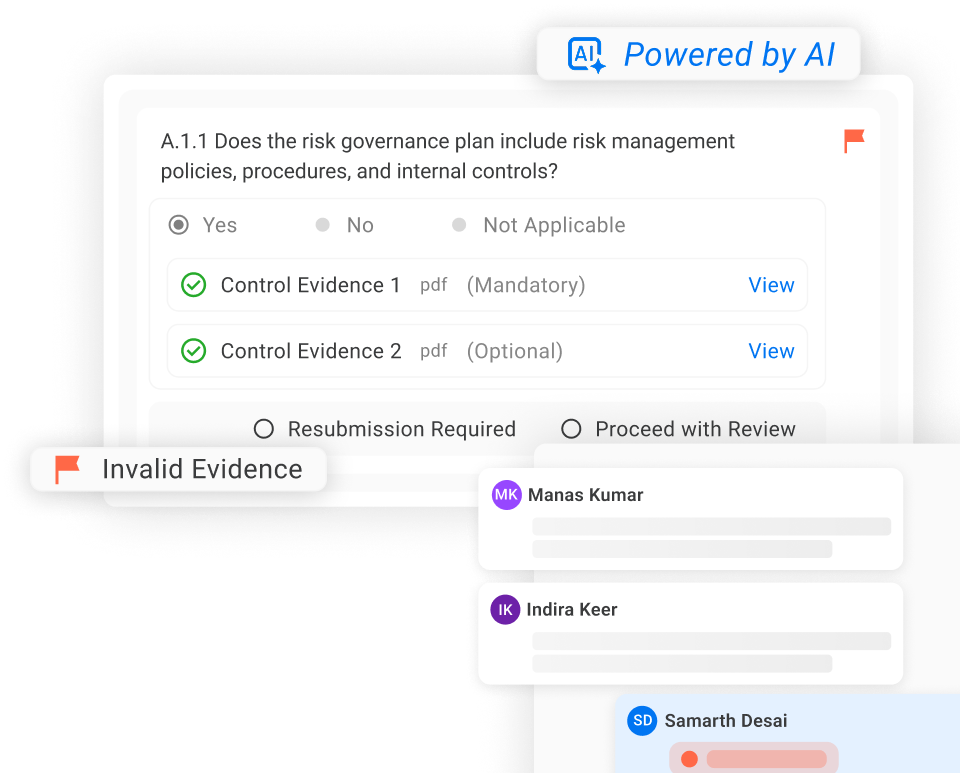

Intelligent Assessment Reviews

A multi-level review framework combining AI-driven analysis with human oversight to evaluate compliance assessments. Automates anomaly detection and risk flagging at scale, while ensuring expert validation for high-risk or complex cases—enhancing accuracy, efficiency, and regulatory defensibility.

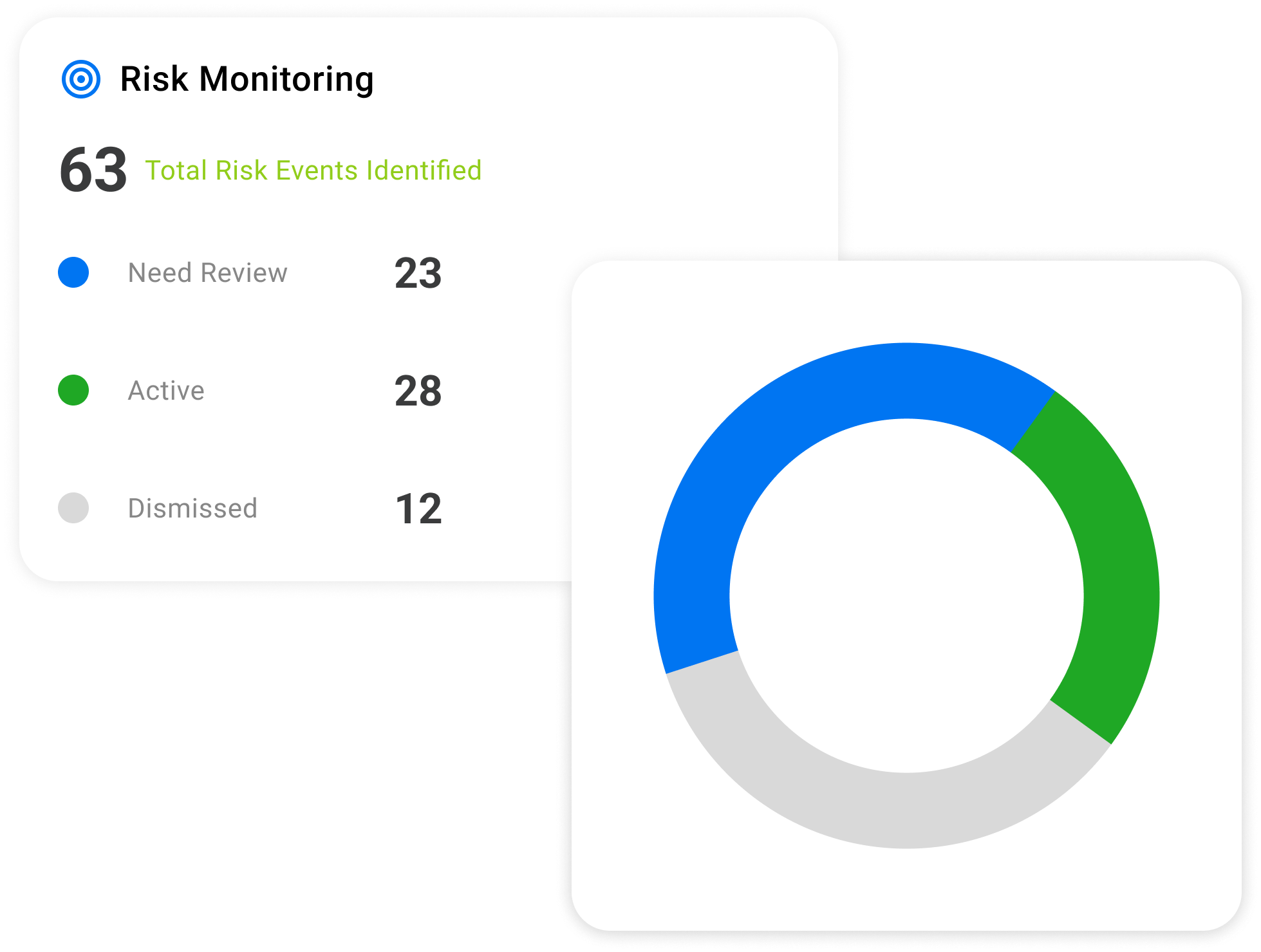

Real-time Risk

Monitoring

Continuously captures and analyzes partner-related risk signals using live data feeds and automated monitoring tools. Delivers real-time visibility into emerging threats, enabling proactive risk mitigation and enhanced compliance with third-party risk management standards.

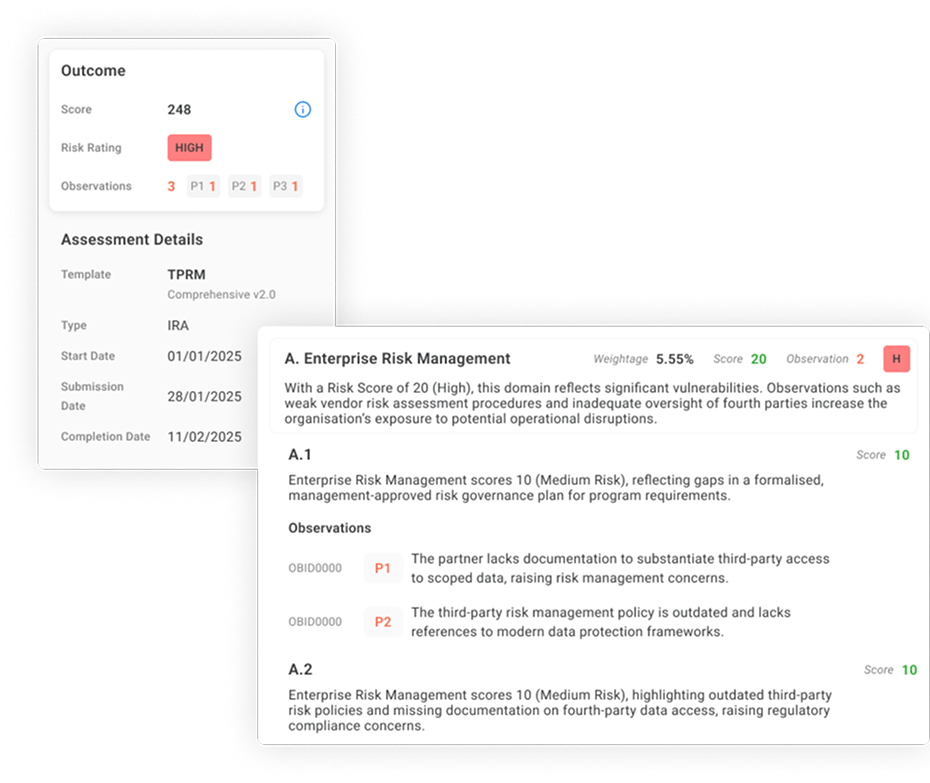

Comprehensive

Assessment Reports

Generate regulator-ready assessment reports with traceable control validation, risk scoring, and audit trail logs. Supports internal audit, compliance, and regulatory examination preparedness.

What

sets us apart.

Discover the advantages that make RegAhead the platform of choice for forward-thinking financial institutions

Engineered for flexibility, security, and scale, our solution delivers measurable improvements in compliance efficiency and effectiveness.

User Experience

Design

Intuitive interface for faster adoption and higher productivity.

Business Process

Automation

Automate tasks to save time and increase operational efficiency, reducing manual effort by up to 70%.

Configurable Workflow Design

Easily customize workflows to fit your unique business processes and regulatory requirements without coding.

Organisation specific Customisation

Personalize the platform to perfectly match your organization’s structure, terminology, and compliance needs.

Integration with Digital

India

Seamlessly connect with Digital India for compliance and growth.

Fine-grained Access

Control

Advanced access controls keep your sensitive data secure at every level.

See it in action.

Book your demo today

Experience firsthand how our platform streamlines compliance, automates workflows, and secures your data-all tailored to your business needs.

MISSION

At the Heart

of our work.

We are driven by purpose and committed to enabling businesses to operate with confidence, clarity, and compliance.

Guided by

purpose driven by

excellence

Shashank Saxena

Founder

Shashank started WhyMinds Global, the early-stage Deep Tech solutions tribe behind RegAhead – after 2 decades of Technology Leadership experience having worked at Silicon Valley, Wall Street, Financial districts of London, Singapore, Mumbai et al. He has held org-wide leadership roles in Engineering and Architecture at respected logos like Morgan Stanley, Deutsche Bank, SMFG, IDFC First Bank etc.

Shashank is an alumnus of BITS Pilani. Has done Specialization program in Fintech from Wharton; Innovation and Leadership program from MIT. He serves on the Board of a leading NBFC and a growing Agri eCommerce company in India. Also does honorary contributions to State Governments and Academia sitting on their Board / Advisory Councils for FinTech and AI advancements.

thoughts that

drive change.

₹5 Crore. 11 Violations. One Big Lesson for the Industry.

Systemic compliance failures caused 11 major violations costing ₹5 crore; regulators tighten norms as industries adopt AI-powered monitoring for transparency

Technology Transformations need Accountability: The IOB-EdgeVerve Incident

Indian Overseas Bank’s new EdgeVerve platform failed, exposing vendor accountability gaps; financial sector now emphasizes governance, resilience, and compliance

AI in GRC: The EU Act Effect

Prepare for the EU AI Act 2025. Learn how to ensure compliance, manage AI risk, and build ethical, future-ready governance